· Cost Efficiency · 4 min read

The Hidden Costs of Manual Document Generation

We cover how operational inefficiencies caused by manual document creation, within the Insurance Industry, add financial and compliance risk.

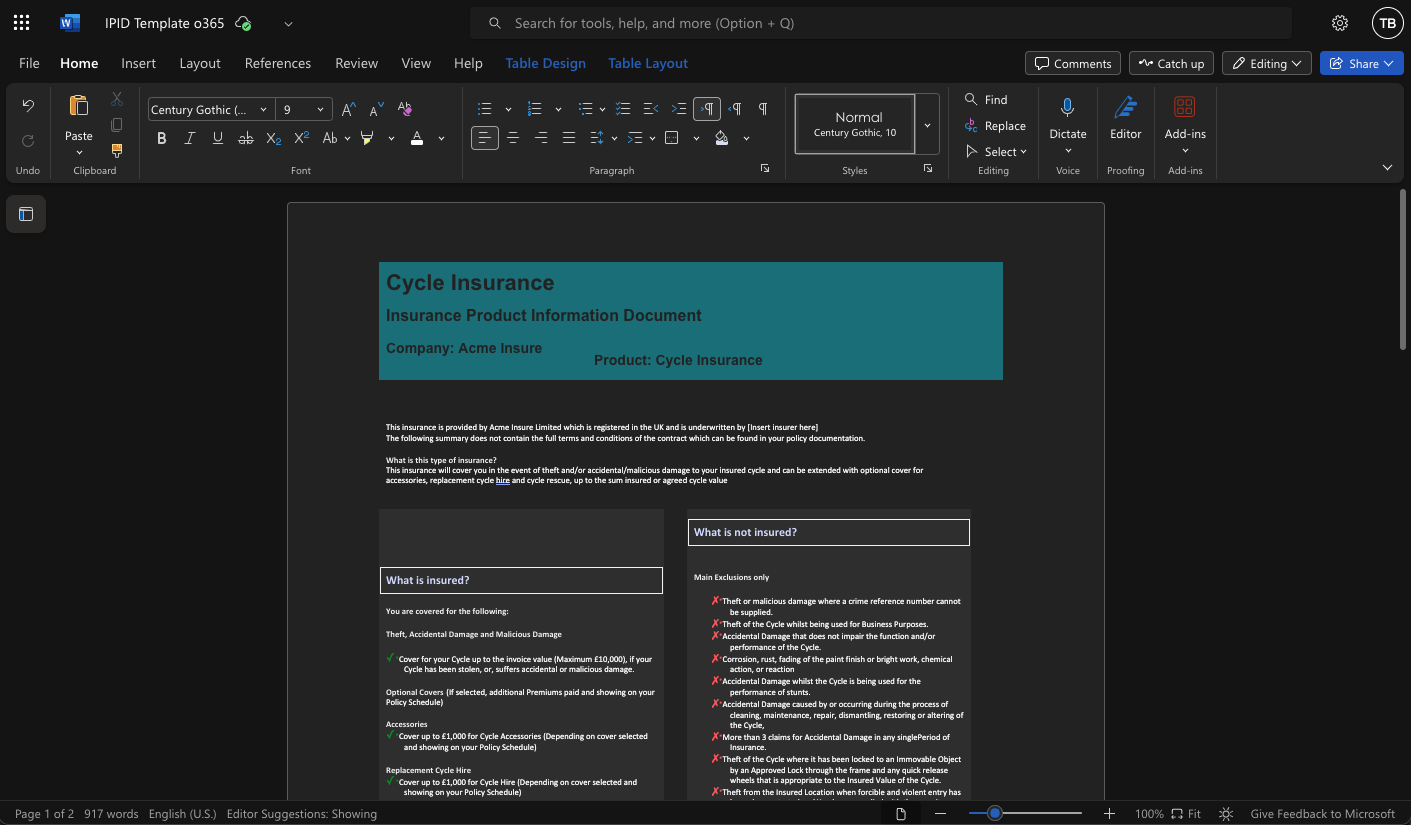

Accuracy and compliance are vitally important within insurance and the way you generate your documents can have widespread consequences within your business. Yet, many insurers still rely on manual processes to create their documents (Such as IPID and Policy wording documents).

A new version of document A is requested by User B, content is managed within system X, and is then emailed to designer Y or agency Z to put together what they hope is an accurate document that reflects the requirements of User B from 3 weeks ago, or even worse, the document is generated from a word-processor template stored on the companies network drive by User B directly with no eyes-on from the legal or marking departments. While this approach may seem manageable at first because someone was told to “just get it done”, it comes with hugh risk, that can significantly impact the quality and accuracy of the content and the compliance of the final document.

Why Manual Document Generation Is a Costly Mistake

Why invest in automation when you already have a team managing the process? The reality is that these manual workflows expose your business to potential errors at each step. Things get lost in transit, emails and spreadsheets become too heavily relied upon and the audit trail gets fuzzy. The task of checking copy within your legal documentation workflows should focus on checking the content, not worrying about which piece of content is waiting on a team member.

Then after you’ve gone the through the back-and-forth of getting the content approved a dozen times, you have to package the content in a way that can be consumed by whatever process you have to generate the final printable or digitally-hostable asset.

Here are some of the bigger issues with a manual process:

1. Increased Team Sizes

Playing chase-the-content costs you time and money, multiple manual touchpoints with no clear viewport on who’s currently proofreading this and approving that, adds stress and stops your team focusing on what they’re good at.

Consider the following:

- A single policy document and all it’s content will pass through several inboxes before final approval and asset generation.

- Valuable hours copying and pasting details, editing spreadsheets, checking for inconsistencies, and fixing content errors, checking them against other documents that are also going through the same process

- As the number of documents you manage increase, so do the inefficiencies, stretching their existing teams or hiring additional staff to manage the extra meta-tasks, rather than focusing on their actual jobs.

2. Higher Risk of Human Error

Mistakes within your insurance documents can have severe consequences, from incorrect policy details (eg: discrepancies between your policy wording and your IPID) to compliance violations. When documents are manually created, you’re at risk of:

- Data entry errors – Typos, missing information, or duplicated fields.

- Version control issues – Using outdated templates or conflicting document versions.

- Formatting inconsistencies – Non-standard layouts that fail to meet regulatory expectations.

The cost of fixing these errors can be substantial, not just in terms of the time spent in updating the content, but also in the potential reputational damage and failure to comply.

3. Compliance and Regulatory Risks

The insurance industry is heavily regulated, with strict requirements for policy wording, disclosures, and customer communication. Manually managing documents increases the likelihood of non-compliance due to:

- Missed regulatory updates – Outdated documents that do not reflect current laws.

- Inconsistent language – Variations in policy terms that lead to legal disputes.

- Lack of audit trails – Difficulty proving compliance during audits.

Non-compliance can lead to hefty fines, legal challenges, and loss of consumer trust—far outweighing the cost of automation.

4. Slower Turnaround Times and Reduced Productivity

Manual processes slow down document creation, approval, and distribution, affecting both internal teams and the time it takes to get your documents to the customer.

- Delays in policy issuance – Customers wait longer for important documents.

- Bottlenecks in approval workflows – Documents get stuck in manual review cycles.

- Lack of scalability – As document volume increases, manual processes struggle to keep up.

For insurers looking to remain competitive, speed and efficiency are critical.

The Solution: Automating Content Approval Workflows and Document Generation with Ultradoc.io

To mitigate these issues, insurance companies must embrace automation. Ultradoc’s content management system can:

Eliminate manual errors by pulling data directly from trusted sources.

Ensure compliance by maintaining up-to-date templates aligned with regulations.

Reduce labour costs by automating workflows and approvals.

Accelerate document delivery with instant generation and digital distribution.

Reduce discrimination we build and test our documents against assistive technology, assuring that we improve the customer experience for all your customers.

Thinking about automating your document creation?