· Document Types · 5 min read

What is an IPID Document?

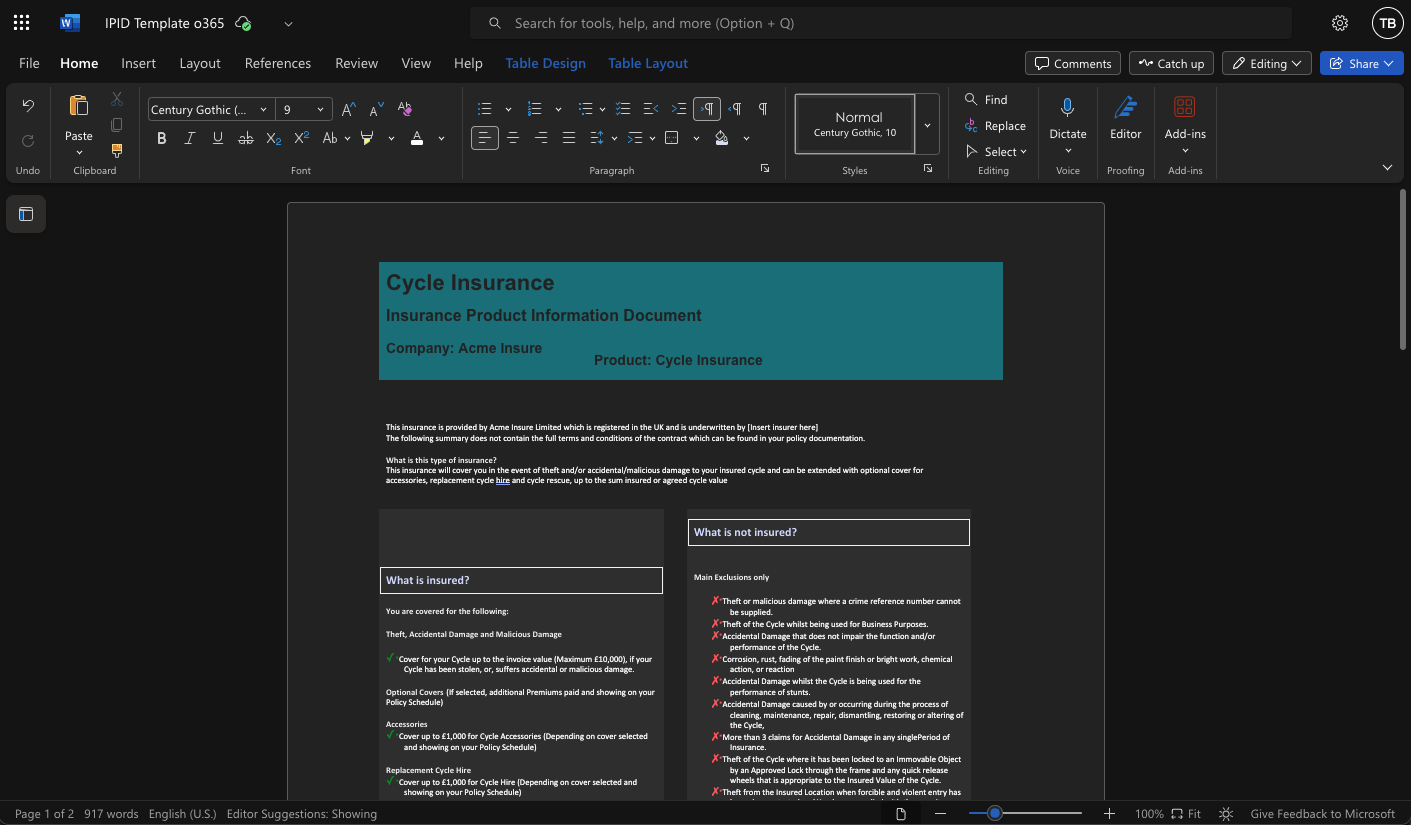

Understanding its Importance in InsuranceDiscover what an IPID (Insurance Product Information Document) is, why it’s important for insurance transparency, and how to generate compliant, professional IPIDs fast

In the world of insurance, clear communication is vital to ensuring that consumers are fully informed about the policies they are purchasing. One of the tools designed to make this process easier and more transparent is the IPID document.

But what exactly is an IPID, and why is it so important?

What is an IPID Document?

IPID stands for Insurance Product Information Document. It’s a standardised document created by insurance providers to help consumers better understand the key features, benefits, and risks associated with an insurance policy. Essentially, the IPID offers a simplified, easy-to-read summary of an insurance product’s most important details, acting as a quick guide for potential buyers.

IPIDs are intended to ensure that consumers have access to clear, concise, and relevant information before they decide to purchase insurance. This document plays a crucial role in promoting transparency in the insurance industry.

Origin of the IPID

The IPID was originally defined as part of the Insurance Distribution Directive (IDD), which sets out the regulations that insurance companies within the EU must follow to ensure clear communication with consumers. The directive requires that an IPID must be provided for certain insurance products, helping to promote transparency and fair treatment of consumers. You can find the full specifications and guidelines for the IPID document on the European Insurance and Occupational Pensions Authority (EIOPA) website.

What is the stance on IPIDs since the UK left the EU?

Since the UK is no longer a member of the European Union, the need to adhere to the Insurance Distribution Directive (IDD) was removed on April 5, 2024. The Financial Conduct Authority (FCA) has replaced the IDD IPID specification with new rules and guidance, as outlined in ICOBS 6 Annex 3 Providing product information by way of a standardised insurance information document, this gives a more detailed outline of what is required of the document, including font-sizes, iconography and bullet image placement.

Why Is an IPID Important?

The introduction of the IPID was driven by the need for greater transparency and clarity in the insurance industry. In many european countries, regulators require insurance companies to provide an IPID for certain types of insurance products, such as life insurance, health insurance, and travel insurance.

Here’s why the IPID is so important:

Simplified Understanding: Insurance policies can be complex and full of jargon. The IPID simplifies things, making it easier for consumers to understand what they are buying, what is covered, and what isn’t.

Comparing Insurance Products: Because IPIDs follow a standardised format, consumers can easily compare different insurance policies. This makes it simpler to assess the value of different products and make an informed decision.

Informed Decisions: By having a clear overview of what an insurance product includes, the consumer is in a better position to decide whether or not the product suits their needs.

Consumer Protection: In many jurisdictions, the IPID is part of a broader effort to protect consumers from hidden fees, unexpected exclusions, or unfair contract terms.

Regulatory Compliance: Insurers that provide an IPID are often adhering to regulatory requirements, ensuring that they remain in compliance with industry standards and best practices.

Key Features of an IPID

An IPID is designed to provide a snapshot of an insurance product’s most relevant information. Here are the main pieces of information that you’ll find summarised within an IPID:

Name of the Insurance Product: The product name is clearly stated, so the consumer knows exactly which insurance policy they are looking at.

Insurer Information: The name of the insurance company offering the policy, along with their contact details, is provided to ensure customers know who they are dealing with.

Policy Summary: The core benefits of the policy, including what is covered and what isn’t, are explained in simple language. This helps consumers understand the extent of their coverage.

Premium Costs: An outline of the premiums that the consumer will need to pay, including how often the payments need to be made (e.g., monthly, annually).

Exclusions: This section highlights what is not covered by the insurance policy, which is crucial for setting proper expectations.

Duration of Coverage: The length of time the insurance coverage will last is included, whether it’s a short-term product or a long-term policy.

Claims Process: The document typically provides a brief description of how the consumer can make a claim if they need to.

Cooling-Off Period: This section outlines whether there is a period in which the consumer can cancel the policy after purchasing it, typically with a full refund.

Risks and Limitations: Some IPIDs also include a section on the limitations of the policy or any potential risks the consumer should be aware of.

IPID vs. Full Policy Documentation

While the IPID provides a concise overview of an insurance policy, it’s important to note that it is not a replacement for the full policy documentation. The full documentation will provide a much more detailed breakdown of all terms and conditions, including fine print, exclusions, and detailed clauses.

The IPID is meant to serve as an introductory document, giving the consumer just enough information to make a preliminary decision or comparison. If a consumer is interested in learning more, they should always refer to the complete policy documentation for further details.

How can Ultradoc help?

Ultradoc has been designed from the ground up to provide a painless interface into generating legal documentation, and the digital and physical copies of those documents without the need for design team involvement. The Ultradoc IPID template is designed to be visually compliant with the IDD and FSA specification, so all you have to worry about is making sure the information with the document is accurate, and we have built AI tools around making that as easy as possible too.